top of page

News & Updates

Search

2020 Seaports and Covid

Seaports, like airports, are considered high quality, low risk monopoly infrastructure assets. Both port types traded around 20x...

Dec 17, 20203 min read

A gas lead recovery from Covid-19 – Pipe dream or Hot Air?

First apologies for the two dad jokes in the one headline – but how often do you get a chance like that😊! The past few weeks have seen a...

Oct 2, 20206 min read

Covid-19 and infrastructure six months on

It was six months ago that team Infradebt was just settling into working from home and putting the finishing touches on our March quarter...

Oct 2, 20204 min read

Duration discount rates and the grumpy views of a middle-aged man….

Over the past few years investors have become obsessed with the record low level of interest rates. Interest rates are the fundamental...

Oct 2, 20203 min read

Chasing yield at the zero bound

A common analogy for a range of yield chasing strategies is “picking up pennies in front of a steam roller”. While this expression is...

Oct 2, 20204 min read

Five Faces of Inflation

The unprecedented monetary response to Covid-19 has sparked a storm of commentary in the financial media (and Twitter) about whether...

Jul 6, 20209 min read

Airports 2020 Q2

Airports are considered high quality, low-risk monopoly infrastructure assets. Prior to the onset of Covid-19 the trailing EV/EBITDAC of...

Jul 6, 20205 min read

COVID-19 Charts

The last four months have been surreal to say the least. We have all felt some form of step change in our lives. But the nagging question...

Jul 5, 20201 min read

Renewable Electricity Policy

The typical new solar or wind farm project has a forecast operating life of 25 to 30 years. In this context, when looking at the current...

Jul 5, 20205 min read

Photon Energy to Add 14 MWp to its PV portfolio in Australia

· The Company has reached financial close for the construction of two PV power plants with a combined capacity of 14 MWp in Leeton, New...

May 28, 20204 min read

This time is different

The saying goes that “This time is different” are the four most expensive words in finance! Well ignoring that – here goes – this is how...

Apr 5, 20204 min read

Key risks – an infrastructure sectoral view

The COVID19 crisis and ensuing credit crunch will hit different assets in different ways. The intention of this article is to provide a...

Apr 4, 20204 min read

Signposts

On the 23rd of January, while most of us didn’t know it, China locked down the entire province of Wuhan, and the world fundamentally...

Apr 4, 20203 min read

IEF & CEFC finance Enerparc NSW Solar Farms

Infradebt and Enerparc Australia (Enerparc) are pleased to announce the close of a A$8.5 million senior debt facility for Enerparc’s Peak...

Dec 17, 20192 min read

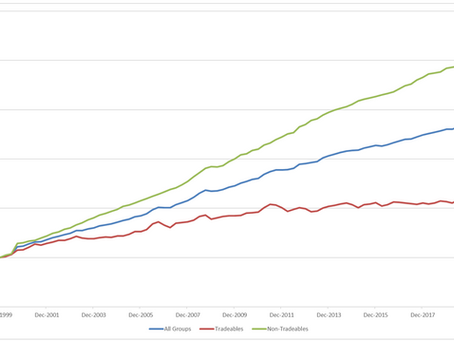

Inflation and Infrastructure Equity Returns – A case of high expectations

Most infrastructure equity investors adopt inflation assumptions in line with the mid-point of the RBA target band – 2.5% per annum. This...

Oct 31, 20194 min read

Regulated WACCs

The Australian 10 year government bond has fallen from 2.7% in 2018 to around 1.0% this quarter. Over the same period of time, there has...

Oct 31, 20193 min read

Airports

Australian airports have been very attractive infrastructure investments. The core of their strong investment returns has been the...

Oct 31, 20192 min read

Weak passenger growth trends for airports

Sydney airport is Australia’s largest airport and releases monthly data on passenger and aircraft movements. This provides a near real...

Jul 9, 20192 min read

Lower base rates - which infrastructure sector wins most?

While the previous article focused on the long-term impact of lower interest rates from an investors’ perspective – it is worth looking...

Jul 9, 20193 min read

Low Interest Rates – the Future Eaters for Long-term Savers

Modern monetary policy (not to be confused with modern monetary theory) has evolved to a point where central banks actively manage...

Jul 9, 20192 min read

bottom of page